Homeowners Insurance

1/11/2022 (Permalink)

Our professional restoration staff will fully document the damage, and help you understand your policy coverage!

Our professional restoration staff will fully document the damage, and help you understand your policy coverage!

If you've recently experienced any type of fire or flood in your home, getting things back to the way they were can take time—and money.

Knowing what to do after a catastrophic event such as these many homeowners may feel hesitant. However, when you have the support of your home insurance policy and a trusted restoration company, you can save yourself from the stress and high expenses that are associated with water and fire damage repairs.

Since navigating restoration insurance claims can be complex, SERVPRO of Longview/Kelso wants to answer a few common questions homeowners have about the process.

5 FAQs about using Home Insurance for Water & Fire Damage Repairs:

Will Water & Fire Damage Repairs Be Covered By My Policy?

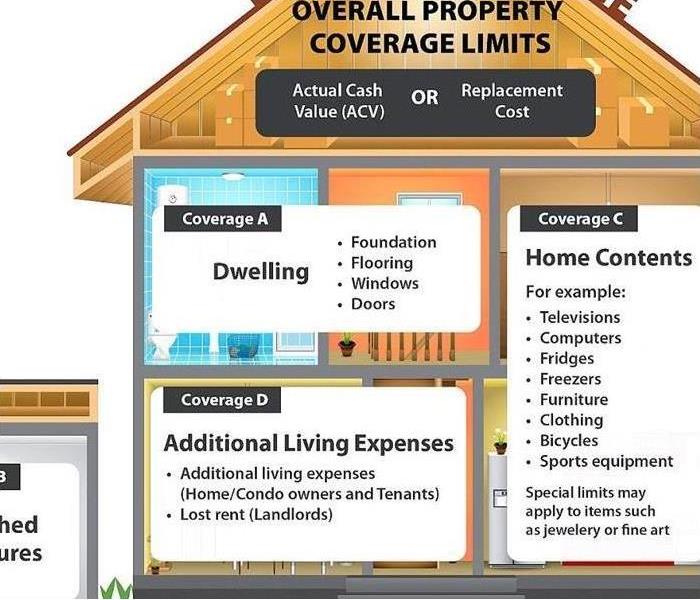

Most home insurance providers cover restoration work related to fire and water damage. Although, this damage typically has to be connected to an event that is covered by your policy—also known as a “peril.” For instance, plumbing emergencies and electrical fires may be acceptable perils, but floods may require additional coverage.

Will Putting Off Repairs Affect My Insurance Policy?

In some cases, fire and water damage may seem minor enough to put off repairs. But, if more damage occurs as a result of negligence, your insurance company may not cover those future claims. By staying proactive and making repairs as soon as possible, you can protect yourself against denied claims down the road.

Should I Call My Insurance Company Before the Restoration Company?

When you have a water and fire damage repair company in mind, it is often best to call them before reaching out to your insurance provider. These professionals will fully document the damage, making it easier to file an accurate claim. They will also provide the proactive care to keep your home safe, as well as prevent further damage.

Can I Choose My Own Restoration Provider?

If you do call your insurance provider first, they may recommend a company for your home repairs. While it’s perfectly acceptable to use these references, it is not required. In fact, it is your right as a policyholder to choose who repairs your property.

When Should I Pay Out-of-Pocket?

If your insurance deductible is higher than the cost of the repairs, it is generally best to pay out-of-pocket. In these instances, you would have been required to pay the whole price anyway without any coverage from your provider. Nonetheless, many water and fire restoration jobs will exceed the cost of the deductible.

In a perfect world, homeowners would always be able to avoid these situations—but accidents still happen.

Fortunately, it’s easy to stay prepared when you have SERVPRO of Longview/Kelso near by. Servicing everything from mold remediation to fire damage repairs, our restoration company will ensure you receive fast, expert care. Visit them online to learn more about their services or call (360) 703-3884 to request 24/7 emergency assistance.

24/7 Emergency Service

24/7 Emergency Service